Our representatives cannot provide your requested refund amount, even after verifying your identity. You may also call 1-80 to check on the status of your federal income tax refund. To resolve your issue, review the Social Security number and refund amount you entered to confirm they're correct.

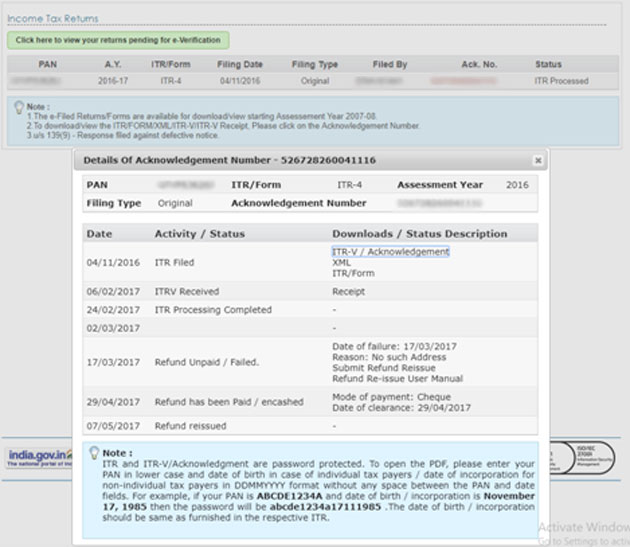

After four attempts, you won't be able to access your status for 24 hours. If you enter information that doesn't match our system, you'll receive an error message. You cannot use Check Your Refund Status to view the status of a payment. To view Refund/ Demand Status, please follow the below steps: Login to e-Filing website with User ID, Password, Date of Birth / Date of Incorporation and. To determine the status of your Personal Income Tax refund for the current tax year, you will need: Your Social Security Number and The amount of your. If the line on your return where you request a refund amount is blank or you entered zero, you have not requested a refund and cannot use our Check Your Refund Status tool. It may take more than 20 weeks to process prior year tax returns. The status of previous tax returns is available if you call 50 and speak to an examiner. If you don't have a copy of your return, see I don't have a copy of my tax return. The Where’s My Refund Page only allows you to check the current year’s tax return. Find your requested refund amount by form and tax year If you filed Check the status of your refund Refund Status Video Refund Checks Which are No Longer Negotiable (Expired) Under Nebraska law, tax refund checks (refund. Locate the refund amount you requested on your tax return using the chart below. When you use Check Your Refund Status, you'll enter information we use to verify your identity.

0 kommentar(er)

0 kommentar(er)